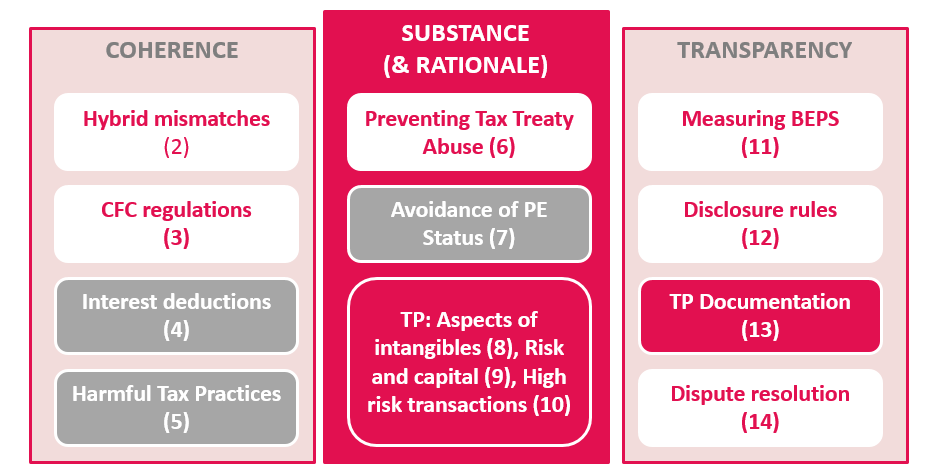

BEPS Actions - OECD BEPS

Action 3 - OECD BEPS

Tiberghien Economics - BEPS

Base erosion and profit shifting - OECD BEPS

For the Record : Newsletter from Andersen : May 2015 : Addressing International Tax Planning in the Changing BEPS Landscape

Limiting Base Erosion Involving Interest Deductions and Other Financial Payments, Action 4 - 2015 Final Report

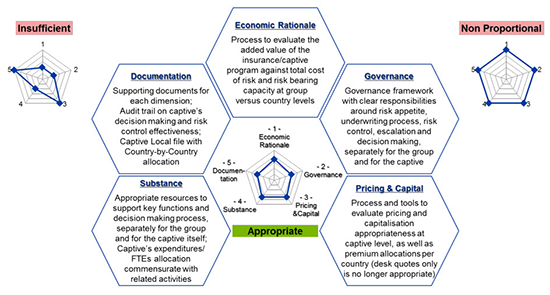

BEPS update: impact on the aviation leasing industry

OECD Tax on X: How are countries implementing the #BEPS Action 5⃣ standard for the exchange of information on #tax rulings? 🟢 81 jurisdictions fully in line 🟡 43 jurisdictions receive one

Base Erosion and Profit Shifting (BEPS)

OECD presents outputs of OECD/G20 BEPS Project recommending reforms to the international tax system for curbing avoidance by multinational entreprises - Sagasser Selas, Tax and Law Firm

/product/79/385154/1.jpg?1915)