- Accueil

- portfolio 900

- Portfolio trading breaks into new markets - The DESK - The leading source of information for bond traders

Portfolio trading breaks into new markets - The DESK - The leading source of information for bond traders

4.8 (615) · € 23.99 · En Stock

Emerging markets are adopting PT to add efficiency to liquidity sourcing, writes Matt Walters of MarketAxess. Portfolio trading has seen a lot of success and now it is expanding into emerging markets as part of its continued growth. Traders across the buy- and sell-side are finding new applications and situations in which it can be highly effective. TRACE data in the US indicates that portfolio trading volumes increased by US$100 billion in 2022 versus 2021. That was led by taking activity from voice trading. The growth of our own Portfolio Trading volume has also been rapid - in 2022 we

Portfolio trading just keeps growing - The DESK - The leading

The promise of AI in corporate bond trading

Low Stock Market Volatility Masks 'Pain Under the Surface

Bond portfolio trades are cheap as chips. Why?

:max_bytes(150000):strip_icc()/blocktrade.asp-final-e6b9cd66dd8e42168655c1bc5b16b458.png)

Block Trade: Definition, How It Works, and Example

Credit Hedge Funds: Industry, Trades, Recruiting, Careers

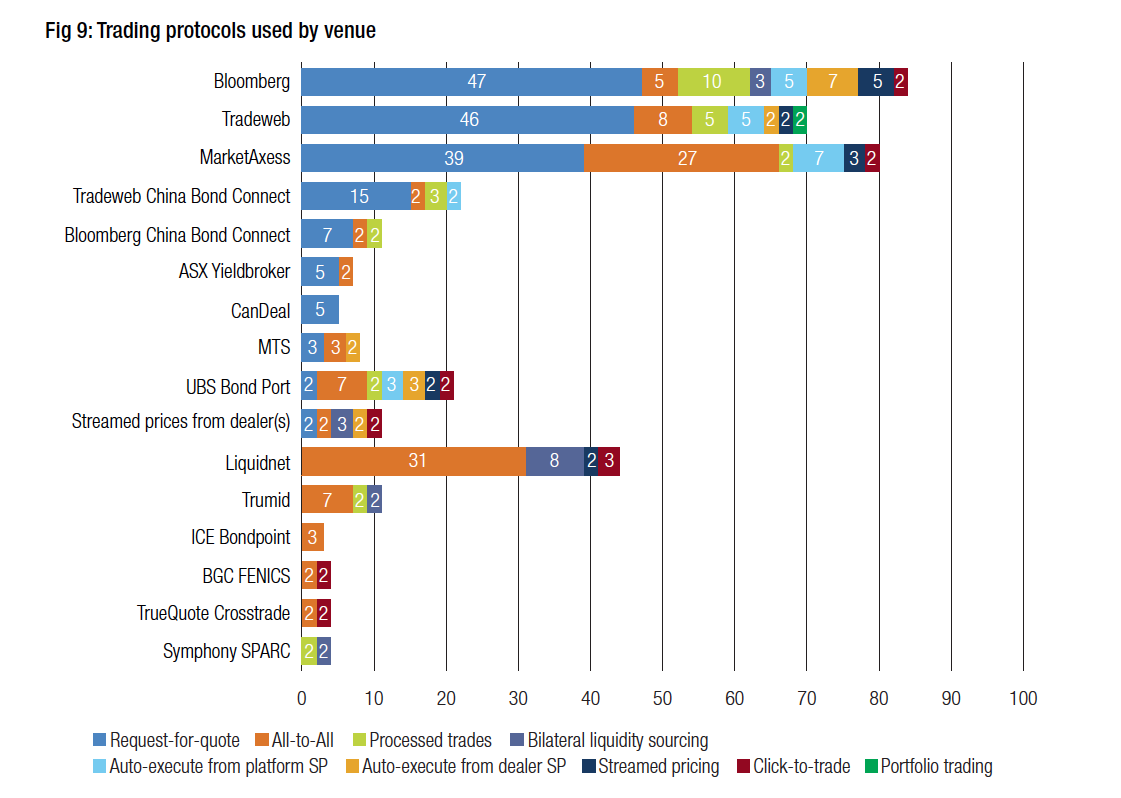

Research: Trading Protocols Survey 2022 - The DESK - The leading

How portfolio trading is transforming the bond markets

Research: Trading Protocols Survey 2022 - The DESK - The leading

Portfolio trading is on the up but only some can make it pay - The

Fixed Income Trading: What It Is, Plus Interview & Career Guide

Credit Portfolio Trading Booms

The DESK's Trading Intentions Survey 2021 - Best Execution

How do you get a job in sales and trading in an investment bank?